December 21, 2017, Vancouver, B.C., Metallic Minerals Corp. (TSX-V: MMG; US OTC: MMNGF) (“Metallic Minerals” or the “Company”) is pleased to announce drill results from six holes drilled on two parallel vein targets on the Homestake block at its 100%-owned Keno Silver Project in Canada’s Yukon Territory. A total of 1,320 meters of diamond drill core was collected from 14 holes drilled in 2017 on areas prioritized during initial exploration work, namely two vein targets at Homestake (see Figure 1) and the previously announced high-grade results at the Caribou and Duncan targets. The results discussed herein show that the Homestake targets are vein structures within a broad structural corridor nearly 200 metres wide, with both longitudinal and transverse-style veins. The Homestake #1 vein shows classic Keno style, high-grade silver-lead-zinc mineralization, whereas the #2 vein also shows significantly elevated gold, which is characteristic of some structures in the larger deposits within the Keno Hill silver district. The strongest grades to date include assays of 4,027 g/t silver from drilling and 4,717 g/t silver from trenching on the Homestake #1 vein, and 22.1 g/t gold with 332 g/t silver from trenching on the Homestake #2 vein. The Homestake vein systems are exposed at the surface and are open to further expansion down dip and along trend (see Figures 2, 3 and 4).

The objective at the Homestake targets was to drill below, and along trend of, the shallow historic mining and sampling on the structure to determine the potential of the systems to host significant high-grade silver, lead, zinc and gold, and to provide vectors to assist follow-up exploration aimed at pursuing higher-grade material. All six 2017 drill holes intersected the mineralized Homestake structures, with highlight assays for all results to date shown below in Table 1. Offset drilling on the Homestake #1 and #2 vein structures is a key component of the planned 2018 exploration program, particularly down dip and along strike in a broad window of more massive Keno Hill quartzite, one of the preferred host rocks in the district.

Table 1: Highlighted Drill Results from the Homestake #1 and #2 Vein Structures

Hole | Vein # | From (m) | To (m) | Width (m) | Ag g/t | Pb % | Zn % | Au g/t | Ag Eq g/t |

HS17-024 | HS2 | 31.86 | 33.14 | 1.28 | 8 | 0.11 | 0.15 | 2.460 | 214 |

Including | 32.69 | 33.14 | 0.45 | 16 | 0.18 | 0.12 | 6.600 | 547 | |

HS17-027 | HS1 | 74.64 | 75.60 | 0.96 | 207 | 3.62 | 0.09 | 0.002 | 383 |

Including | 74.64 | 75.13 | 0.49 | 364 | 6.30 | 0.06 | 0.004 | 665 | |

And | 76.48 | 77.50 | 1.02 | 569 | 1.02 | 0.03 | 0.010 | 620 | |

HS10-001 | HS2 | 47.30 | 50.10 | 2.80 | 59 | 0.81 | 0.37 | 2.500 | 312 |

Including | 48.75 | 50.10 | 1.35 | 71 | 1.00 | 0.61 | 4.840 | 530 | |

HS10-006 | HS2 | 73.15 | 74.91 | 1.76 | 522 | 0.47 | 0.25 | 0.030 | 560 |

Including | 73.15 | 73.37 | 0.22 | 4027 | 1.00 | 0.65 | 0.170 | 4122 | |

HS10-009 | HS2 | 32.38 | 34.99 | 2.61 | 110 | 0.49 | 0.06 | 1.510 | 253 |

Including | 33.35 | 34.09 | 0.74 | 359 | 1.00 | 0.02 | 4.880 | 789 | |

08HS004A | HS1 | 79.80 | 80.60 | 0.80 | 24 | 1.01 | 0.74 | 1.510 | 229 |

Including | 79.80 | 80.10 | 0.30 | 63 | 2.67 | 0.76 | 3.910 | 535 | |

08HS009 | HS2 | 40.50 | 42.70 | 2.20 | 37 | 1.30 | 0.38 | 1.150 | 209 |

Including | 40.50 | 40.90 | 0.40 | 98 | 4.29 | 0.83 | 3.300 | 603 | |

And | 43.70 | 45.00 | 1.30 | 109 | 4.10 | 0.04 | 2.000 | 461 | |

Including | 43.70 | 44.10 | 0.40 | 232 | 6.43 | 0.10 | 1.320 | 644 |

Equivalent (Ag Eq g/t) values assume Ag $16/oz, Pb $1.10/lb, Zn $1.25/lb, Au $1,250/oz, and 100% recovery.

Metallic Minerals’ CEO and Chairman, Greg Johnson stated, “Homestake was one of our top four advanced targets for 2017, due to its historic production, the very high grades at surface and its stratigraphic setting, which is comparable with some of the largest deposits in the district. We are very pleased with these results which confirm the existence of high-grade, well-mineralized 1-3 metre-wide structures that are typical of the Keno Hill silver district and which remain open to depth and along trend. We now have 21 vein intersections grading more than 600 g/t silver equivalent on the Homestake structures including five that exceed 10 g/t gold on the Homestake #2 structure. The average resource grade in the Keno Hill silver district is 400-500 g/t silver1 and the average reserve grade for primary silver deposits in the industry is approximately 300 g/t2. Future work at the Homestake targets will focus on step out drilling to determine the ultimate scale of the mineralized system and to pursue targets considered to have the highest potential to host additional higher-grade material. We anticipate conducting a robust 2018 exploration program that will continue our focused, systematic exploration approach to rapidly advance additional priority targets to drill-ready stage, along with step out drilling on our most advanced targets as we move toward potential resource delineation.”

1Alexco Resource Corp: Alexco Announces Positive Preliminary Economic Assessment for Expanded Silver Production at Keno Hill, March 2017

2New Explorer for High-Grade Silver Resources in the Prolific Keno Hill Silver District of Yukon, Canada; Michael Fowler, Loewen, Ondaatje, McCutcheon Ltd (LOM), September 2017

Table 2: Highlighted Trenching Results from the Homestake #1 and #2 Vein Structures

Trench | Vein # | Length (m) | Ag g/t | Pb % | Zn % | Au g/t | Ag Eq g/t |

HS_TR4_b | HS1 | 0.7 | 1155 | 6.27 | 10.10 | 0.300 | 2015 |

HS_TR4_d | HS1 | 1.3 | 520 | 5.28 | 1.28 | 0.270 | 858 |

Including | HS1 | 0.3 | 1592 | 22.70 | 0.90 | 0.630 | 2759 |

HS_TR4_p2 | HS1 | 2.0 | 1564 | 12.95 | 6.11 | 0.310 | 2525 |

HS_TR4_p3 | HS1 | 3.0 | 1650 | 15.23 | 0.49 | 0.240 | 2413 |

Including | HS1 | 0.8 | 4717 | 26.00 | 0.80 | 0.700 | 6040 |

HS_Shaft_B | HS1 | 0.9 | 3168 | 0.15 | 2.60 | 4.670 | 3679 |

HS_TR1_g | HS2 | 1.5 | 95 | 3.48 | 0.32 | 6.070 | 751 |

Including | HS2 | 0.4 | 332 | 13.00 | 0.60 | 22.100 | 2704 |

HS_TR5_b | HS2 | 2.8 | 147 | 6.74 | 0.10 | 10.160 | 1264 |

Including | HS2 | 1.2 | 171 | 7.09 | 0.10 | 17.900 | 1909 |

Including | HS2 | 0.6 | 340 | 17.20 | 0.10 | 10.000 | 1937 |

Equivalent (Ag Eq g/t) values assume Ag $16/oz, Pb $1.10/lb, Zn $1.25/lb, Au $1,250/oz, and 100% recovery

The Homestake targets occur along the Homestake trend; one of the 12 known mineralized trends running across the Keno Silver District and traversing Metallic Minerals ground. It is the next major mineralized trend 2 kilometers east of the trend that hosts Alexco Resource Corp’s Bellekeno mine and is similarly underlain by the main Keno Hill quartzite package and locally-intruded by greenstone sills, which are the two key rock units that host most of the production and resources in the district. Originally discovered and worked in the 1920s and 30s, several tons of direct shipping ore were historically mined at the Homestake property. Limited exploration including trenching was completed on the Homestake block during the 1960s and 70s, with some shallow drilling and surface trenching conducted between 2008 and 2011. Both efforts returned significant high-grade results (see Table 3 and 4 below).

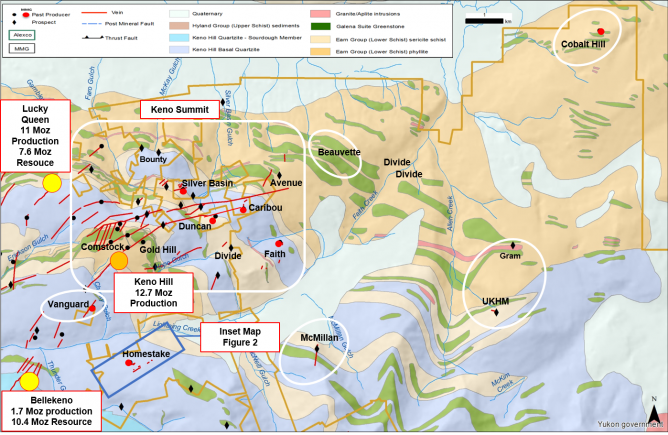

Figure 1: Keno Silver Project Priority Targets Map

Exploration by Metallic Minerals on the Homestake targets in 2017 followed up the historic surface work with detailed stratigraphic mapping, magnetic and VLF geophysical surveys, as well as the extension of soil sample grids over the broad target area. Through this preliminary work, it was recognized that there was potential on the Homestake targets to significantly expand the known strike extent of mineralization by testing the more massive Keno Hill quartzite to the east of the main showings.

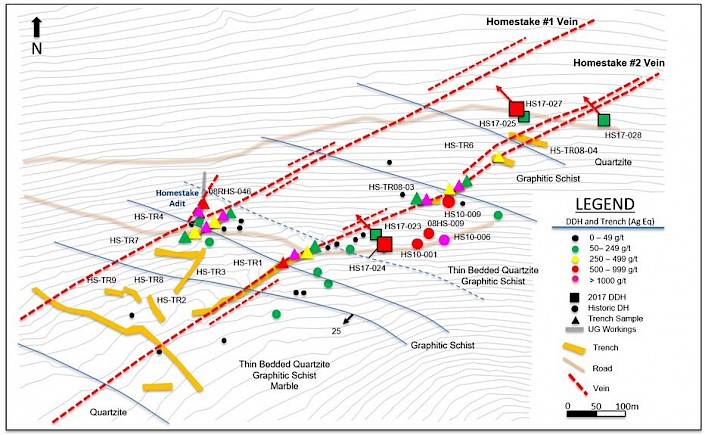

Diamond drilling in 2017 focused on testing down dip below the shallow historic sampling and along the structure to determine the potential depth and lateral extension of the open-ended mineralization in the best potential host rocks. Three drill holes successfully tested this concept by stepping out approximately 250 metres from the closest drill intercept of the #1 vein and 600 metres from the main cluster of previous drilling on the #2 vein (See Figure 2 below). The width of the structure in this area was particularly notable, extending over 15 meters in three mineralized structures. It is anticipated that future drilling will follow up the continuation of these holes down dip and along strike to the east as well as test the massive quartzite stratigraphy to the west of the main showing.

Figure 2: Homestake Target Drill Hole Location Map

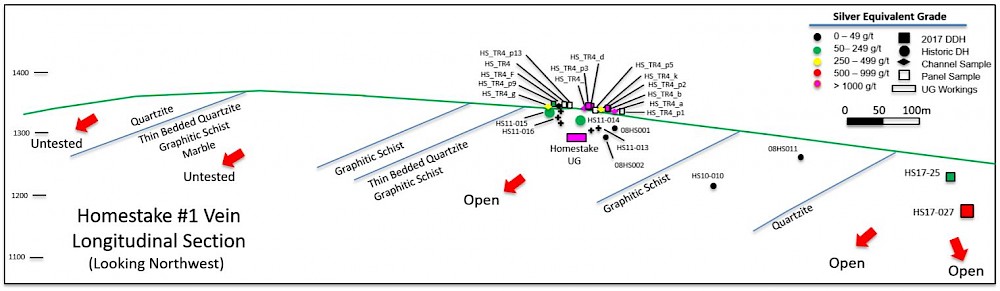

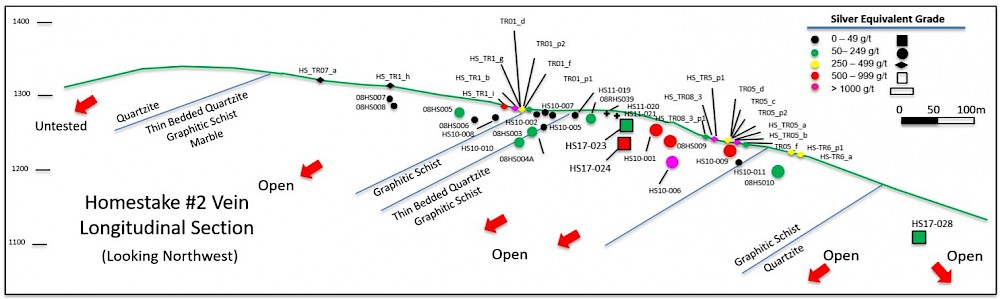

Drilling on the Homestake structures shows that they remain open to expansion down dip and along strike and that there remains significant exploration upside with the potential to rapidly develop a resource on this target (see Long Sections in Figures 3 and 4 below). Drill holes and trenches are shown on these longitudinal sections, with their respective grades, where they intersect the plane of the vein. Stratigraphic sections containing quartzite are the most favorable setting at Homestake to host significant mineralization.

Planned work in 2018 at Homestake would include continuation of step-out drilling along the best mineralized shoots within the quartzite stratigraphy down dip and along trend as shown on the sections below as open or untested. Greenstone sills in the area may also become important hosts at the Homestake block and follow up work will assess this potential.

Figure 3: Homestake Vein # 1 Long Section

Figure 4: Homestake Vein # 2 Long Section

Priority Target Areas for Follow Up in 2018

Metallic Minerals is in the advanced planning stages for the 2018 field season at its Keno Silver Project. A focus of this work is expected to include follow-up drilling on our priority targets at Caribou and Homestake where the combined historic and recent drilling may allow for rapid development of resources. Additional drill-focused exploration work is intended to include follow-up drilling on the Duncan target, the 2017 discoveries at the Bounty and Gold Hill target areas, remaining drill ready targets at Vanguard, Silver Basin and Silver Queen, as well as on the recently acquired Formo property, which has an historic resource estimate.

Further exploration activities will continue to focus on advancing known targets to the drill-ready stage through application of the exploration techniques successfully demonstrated during the 2017 field season, including detailed stratigraphic mapping, soil sampling, trenching and geophysics. Follow up exploration will also continue on the earlier stage targets on the highly prospective, but lesser explored targets on the eastern and southern edges of the Keno Silver Project.

Table 3: Homestake #1 and #2 Comprehensive Drill Results

Hole | Vein # | From (m) | To (m) | Width (m) | Ag g/t | Pb % | Zn % | Au g/t | Ag Eq g/t |

HS17-027 | HS1 | 74.64 | 75.60 | 0.96 | 207 | 3.62 | 0.09 | 0.002 | 383 |

Including | 74.64 | 75.13 | 0.49 | 364 | 6.30 | 0.06 | 0.004 | 665 | |

And | 76.48 | 77.50 | 1.02 | 569 | 1.02 | 0.03 | 0.010 | 620 | |

HS11-015 | HS1 | 17.20 | 18.10 | 0.90 | 48 | 0.57 | 0.29 | 0.020 | 92 |

And | 19.60 | 20.60 | 1.00 | 20 | 0.14 | 0.42 | 0.010 | 51 | |

08HS004A | HS1 | 75.00 | 77.40 | 2.40 | 11 | 0.44 | 0.08 | 0.310 | 59 |

And | 79.80 | 80.60 | 0.80 | 24 | 1.01 | 0.74 | 1.510 | 229 | |

08RHS046 | HS1 | 6.10 | 7.62 | 1.52 | 70 | 1.17 | 0.45 | 0.020 | 151 |

HS17-023 | HS2 | 27.65 | 29.15 | 1.50 | 21 | 0.19 | 0.02 | 0.290 | 54 |

HS17-024 | HS2 | 31.86 | 33.14 | 1.28 | 8 | 0.11 | 0.15 | 2.460 | 214 |

Including | 32.69 | 33.14 | 0.45 | 16 | 0.18 | 0.12 | 6.600 | 547 | |

HS17-028 | HS2 | 101.70 | 102.80 | 1.10 | 24 | 0.01 | 0.01 | 0.400 | 57 |

And | 105.30 | 106.20 | 0.90 | 4 | 0.05 | 0.05 | 1.900 | 157 | |

And | 116.80 | 117.50 | 0.70 | 3 | 0.07 | 0.58 | 0.480 | 75 | |

HS10-001 | HS2 | 47.30 | 50.10 | 2.80 | 59 | 0.81 | 0.37 | 2.500 | 312 |

Including | 48.75 | 50.10 | 1.35 | 71 | 1.00 | 0.61 | 4.840 | 530 | |

And | 50.70 | 52.50 | 1.80 | 53 | 0.45 | 0.71 | 0.080 | 119 | |

HS10-002 | HS2 | 7.01 | 7.38 | 0.37 | 39 | 0.69 | 0.01 | 0.180 | 86 |

HS10-006 | HS2 | 73.15 | 74.91 | 1.76 | 522 | 0.47 | 0.25 | 0.030 | 560 |

Including | 73.15 | 73.37 | 0.22 | 4027 | 1.00 | 0.65 | 0.170 | 4122 | |

HS10-009 | HS2 | 32.38 | 34.99 | 2.61 | 110 | 0.49 | 0.06 | 1.510 | 253 |

Including | 33.35 | 34.09 | 0.74 | 359 | 1.00 | 0.02 | 4.880 | 789 | |

08HS003 | HS2 | 39.30 | 40.60 | 1.30 | 54 | 0.07 | 0.06 | 0.050 | 64 |

08HS005 | HS2 | 10.90 | 11.30 | 0.40 | 35 | 0.03 | 0.10 | 0.130 | 52 |

And | 49.50 | 52.00 | 0.30 | 8 | 0.02 | 0.16 | 0.420 | 50 | |

08HS009 | HS2 | 40.50 | 42.70 | 2.20 | 37 | 1.3 | 0.38 | 1.150 | 209 |

Including | 40.50 | 40.90 | 0.40 | 98 | 4.29 | 0.83 | 3.300 | 603 | |

And | 43.70 | 45.00 | 1.30 | 109 | 4.1 | 0.04 | 2.000 | 461 | |

Including | 43.70 | 44.10 | 0.40 | 232 | 6.43 | 0.10 | 1.320 | 644 | |

08HS010 | HS2 | 82.20 | 82.40 | 0.20 | 4 | 0.04 | 0.07 | 0.550 | 52 |

Table 4: Homestake #1 and #2 Comprehensive Trenching Results

Trench | Vein # | Length (m) | Ag g/t | Pb % | Zn % | Au g/t | Ag Eq g/t |

HS_Shaft_A | HS1 | 1 | 278 | 1.88 | 1.50 | 0.000 | 447 |

HS_Shaft_B | HS1 | 0.9 | 3168 | 0.15 | 2.60 | 4.670 | 3679 |

HS_TR4_b | HS1 | 0.7 | 1155 | 6.27 | 10.10 | 0.295 | 2015 |

HS_TR4_d | HS1 | 1.3 | 520 | 5.28 | 1.28 | 0.271 | 858 |

Including | HS1 | 0.3 | 1592 | 22.70 | 0.90 | 0.630 | 2759 |

Including | HS2 | 0.6 | 340 | 17.20 | 0.10 | 10.000 | 1937 |

HS_TR4_g | HS1 | 1.1 | 284 | 1.41 | 2.00 | 0.052 | 461 |

HS_TR4_j | HS1 | 0.4 | 761 | 5.72 | 1.50 | 0.056 | 1116 |

HS_TR4_k | HS1 | 0.4 | 228 | 0.07 | 0.50 | 0.070 | 263 |

HS_TR4_m | HS1 | 0.3 | 872 | 8.79 | 3.00 | 0.385 | 1477 |

HS_TR4_p2 | HS1 | 2 | 1564 | 12.95 | 6.11 | 0.305 | 2525 |

HS_TR4_p3 | HS1 | 3 | 1650 | 15.23 | 0.49 | 0.237 | 2413 |

Including | HS1 | 0.8 | 4717 | 26.00 | 0.80 | 0.700 | 6040 |

HS_ TR1_b | HS2 | 0.5 | 97 | 3.95 | 1.90 | 11.400 | 1276 |

HS_TR1_g | HS2 | 1.5 | 95 | 3.48 | 0.32 | 6.071 | 751 |

HS_TR1_i | HS2 | 0.3 | 267 | 1.97 | 0.90 | 0.075 | 414 |

HS_TR5_b | HS2 | 2.8 | 147 | 6.74 | 0.10 | 10.157 | 1264 |

Including | HS2 | 1.2 | 171 | 7.09 | 0.10 | 17.900 | 1909 |

HS_TR5_p1 | HS2 | 4 | 285 | 12.29 | 0.40 | 2.765 | 1102 |

HS_TR6_a | HS2 | 0.3 | 45 | 1.76 | 4.40 | 0.265 | 384 |

HS_TR6_b | HS2 | 0.5 | 116 | 1.67 | 1.60 | 1.320 | 384 |

TR01_d | HS2 | 0.5 | 66 | 0.64 | 2.00 | 3.110 | 446 |

TR01_e | HS2 | 0.4 | 20 | 2.11 | 0.60 | 9.130 | 865 |

TR01_f | HS2 | 0.4 | 167 | 11.76 | 2.70 | 7.800 | 1475 |

TR01_p1 | HS2 | 1 | 28 | 1.79 | 0.47 | 11.050 | 1000 |

TR05_d | HS2 | 0.8 | 85 | 3.05 | 0.00 | 1.500 | 346 |

TR05_e | HS2 | 1.5 | 89 | 4.13 | 0.10 | 2.240 | 464 |

Silver Equivalent (Ag Eq g/t) values assume Ag $16/oz, Pb $1.10/lb, Zn $1.25/lb, Au $1,250/oz, and 100% recovery.

About Metallic Minerals Corp.

Metallic Minerals Corp. is a growth stage exploration company focused on the acquisition and development of high-grade silver and gold in the Yukon within under explored districts with potential to produce top-tier assets. Our objective is to create value through a disciplined, systematic approach to exploration, reducing investment risk and maximizing probability of long-term success. Our core Keno Silver Project is located in the historic Keno Hill Silver District of Canada's Yukon Territory, a region which has produced over 200 million ounces of silver and currently hosts one of the world’s highest-grade silver resources. The Company’s McKay Hill Project, northeast of Keno Hill, is a high-grade historic silver-gold producer. Metallic Minerals is also building a portfolio of gold royalties in the historic Klondike Gold District. Metallic Minerals is led by a team with a track record of discovery and exploration success, including large scale development, permitting and project financing.

FOR FURTHER INFORMATION, PLEASE CONTACT:

Website: www.metallic-minerals.com

Email: chris.ackerman@metallic-minerals.com

Phone: 604-629-7800

Toll Free: 1-888-570-4420

Quality Assurance / Quality Control

Analytical work in 2017 was done by Bureau Veritas Commodities Canada Ltd. with sample preparation in Whitehorse, Yukon and geochemical analysis in Vancouver, British Columbia. Each rock (grab) sample was analyzed for 36 elements using an Aqua Regia digestion with inductively coupled plasma-atomic emission spectroscopy (ICP-AES) and inductively coupled Plasma-mass spectrometry (ICP-MS) (AQ202). Samples with over limit silver and gold were re-analyzed using a 30-gram fire assay fusion with a gravimetric finish (FA530-Ag, Au). Over-limit lead and zinc samples were analyzed by multi-acid digestion and atomic absorption spectrometry (MA404) or titration (GC516, GC8917). All results have passed the QAQC screening by the lab.

Qualified Person

Scott Petsel, P.Geo, Vice President, Exploration, is a Qualified Person as defined by National Instrument 43-101. Mr. Petsel has reviewed the scientific and technical information in this news release and approves the disclosure contained herein. Mr. Petsel has reviewed the results of the sampling programs and confirmed that all procedures, protocols and methodologies used conform to industry standards.

Forward-Looking Statements

Forward Looking Statements: This news release includes certain statements that may be deemed "forward-looking statements". All statements in this release, other than statements of historical facts including, without limitation, statements regarding potential mineralization, historic production, estimation of mineral resources, the realization of mineral resource estimates, interpretation of prior exploration and potential exploration results, the timing and success of exploration activities generally, the timing and results of future resource estimates, permitting time lines, metal prices and currency exchange rates, availability of capital, government regulation of exploration operations, environmental risks, reclamation, title, and future plans and objectives of the company are forward-looking statements that involve various risks and uncertainties. Although Metallic Minerals believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results or developments may differ materially from those in the forward-looking statements. Forward-looking statements are based on a number of material factors and assumptions. Factors that could cause actual results to differ materially from those in forward-looking statements include failure to obtain necessary approvals, unsuccessful exploration results, changes in project parameters as plans continue to be refined, results of future resource estimates, future metal prices, availability of capital and financing on acceptable terms, general economic, market or business conditions, risks associated with regulatory changes, defects in title, availability of personnel, materials and equipment on a timely basis, accidents or equipment breakdowns, uninsured risks, delays in receiving government approvals, unanticipated environmental impacts on operations and costs to remedy same, and other exploration or other risks detailed herein and from time to time in the filings made by the companies with securities regulators. Readers are cautioned that mineral resources that are not mineral reserves do not have demonstrated economic viability. Mineral exploration and development of mines is an inherently risky business. Accordingly, the actual events may differ materially from those projected in the forward-looking statements. For more information on Metallic Minerals and the risks and challenges of their businesses, investors should review their annual filings that are available at www.sedar.com.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.