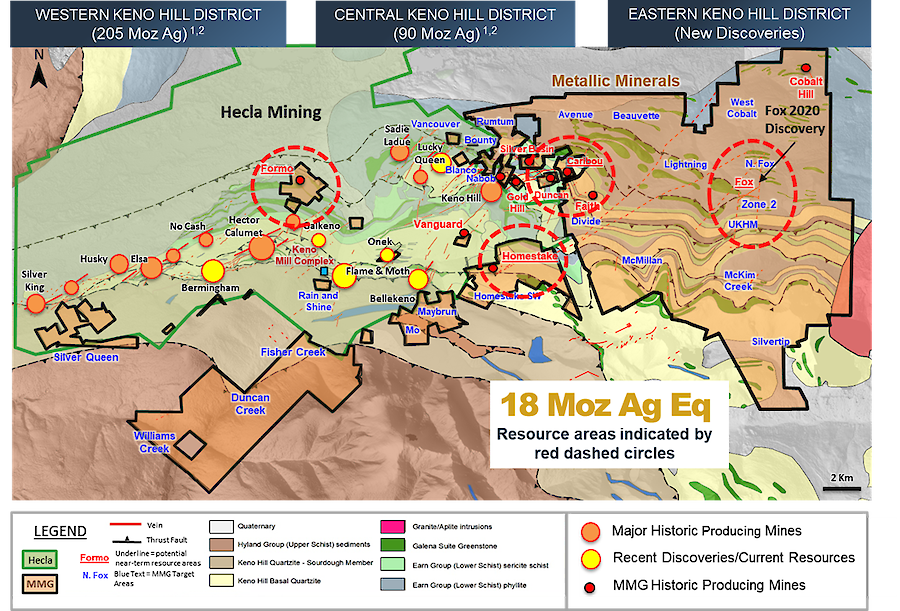

The 100%-owned Keno Silver project consists of 171 square kilometres adjacent to Hecla Mining’s mining operations in the historic Keno Hill Silver District of Canada’s Yukon Territory. The Keno district has produced over 200 million ounces of high-grade silver and currently hosts well over 100 million ounces of silver. The area features excellent infrastructure with access via highway, well-developed and maintained roads on the property and access to the Yukon power grid. Metallic Minerals' land package covers the eastern portion of the district, along with sections on the western and southern sides, and was host to eight historical silver mines with some of the highest grades in the district and five that had average production grades above 5,000 g/t1.

An inaugural mineral resource estimate announced in February 2024 shows the Keno Silver project to host 18.16 million ounces silver equivalent in four shallow deposits, each of which remains completely open at depth and along strike (click here for full mineral resource estimate)2. Subsequent campaigns, anticipated to commence in the 2024 field season, will focus on resource expansion through the drilling of extensions to current deposits, definition drilling of very prospective early-stage drilled targets to new resources, as well as targeting new discoveries at high-priority targets that have yet to be drill tested.

Typical silver deposits in the Keno Hill Silver District consist of high-grade silver veins, typically 1-5 metres in width, grading from 200 g/t to >5,000 g/t silver, with associated lead and zinc sulphides. The largest individual deposits in the district, which range from 10 million to 100 million ounces of contained silver1, are associated with northeast trending, southeast dipping fault/vein structures that form major ore shoots in the preferred host rocks, Keno Hill quartzite and Triassic greenstone.

However, Metallic Minerals’ drilling in the easternmost part of the district confirmed the presence of typical high-grade “Keno-style” occurrences but contained within broad continuous zones of potential bulk-tonnage silver mineralization. These results expand the known extent of drill-defined Keno-style mineralization by 10 kilometers to the east and south of the historic Keno Hill mine and open this major new area of prospective stratigraphy for exploration. The occurrence of mineralization within broad areas of brecciation and pervasive silicification has also expanded the potential favorable host rock settings beyond the main Keno Hill quartzite and greenstones in this area. Multi-kilometer-scale soil anomalies spatially correspond with large geophysical magnetic low features across multiple stratigraphies that may represent magnetite destructive alteration zones or proximal, buried mineralizing intrusive bodies.

The geologic setting at East Keno appears to be similar to those hosting some of the world’s largest bulk-tonnage silver deposits, including Newmont’s Peñasquito, Fortuna’s Caylloma, and SSR’s Chinchillas deposits, which are hosted in breccia, fracture, and stockwork structural zones, as well as higher-grade sheeted veins and structures.

An inaugural mineral resource estimate announced in February 2024 demonstrates the potential of the Keno Silver project to host significant starter resources with 18.16 million ounces silver equivalent in four shallow deposits, each of which remains completely open at depth and along strike.

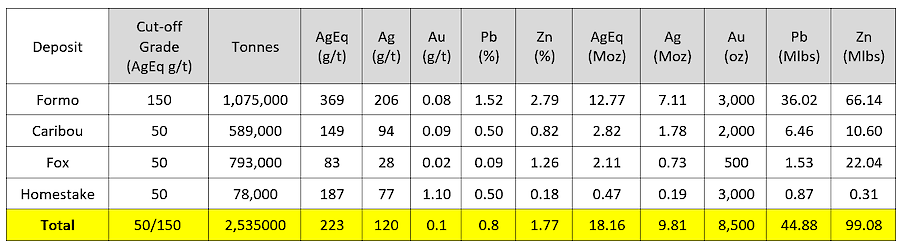

Table 1. Keno Silver Project Mineral Resource Estimates, February 1, 2024

Highlights

• Underground Inferred Mineral Resources, restricted to the Formo deposit, are estimated at 1.08 Mt grading 206 g/t silver, 0.08 g/t gold, 1.52% lead, and 2.79% zinc (369 g/t Ag Eq). The Inferred MRE includes resources of 7.11 Moz of silver, 3,000 oz of gold, 36.02 Mlbs of lead, and 66.14 Mlbs of zinc (12.77 Moz Ag Eq).

• In-Pit Inferred Mineral Resources are estimated at 1.46 Mt grading 58 g/t silver, 0.12 g/t gold, 0.28 % lead, and 1.02 % zinc (115 g/t Ag Eq). The Inferred MRE includes resources of 2.70 Moz of silver, 5,500 oz of gold, 8.86 Mlbs of lead, and 32.95 Mlbs of zinc (5.40 Moz Ag Eq).

• The Formo Deposit is the largest and highest-grade contributor to the 2024 Resource Estimate with 12.77 Moz Ag Eq at a 150 g/t Ag Eq cut-off.

• The 2024 mineral resources represent the equivalent of several years of production through the Keno area mill based on production guidance provided by Hecla which is planning to mine up to 4 million ounces of silver at Keno in 20242.

• Having identified the productive structures and defined starter resources, the Company expects to be able to add significant ounces during subsequent drill campaigns.

The Keno Silver Project 2024 Resource Estimate is a considerable milestone following initiation of exploration in 2017 by the Company on the largely unexplored and previously unconsolidated property. The resource is the culmination of only 18,983 m of drilling over five active field seasons.

Metallic’s contribution to drilling on the project since 2016 has been 18,983 meters in 165 drill holes with total exploration expenditures of $19.46 million. With the 2024 Resource Estimate the Company has demonstrated a highly successful systematic and efficient approach to discovery and resource delineation with approximately 957 Ag Eq ounces per meter drilled (680 Ag Eq ounces per meter delineated when including historic drilling).

Footnotes

1Cathro, R. J. (Bob). Great Mining Camps of Canada 1. The History and Geology of the Keno Hill Silver Camp, Yukon Territory. Geoscience Canada, [S.l.], Sept. 2006. ISSN 1911-4850; Boyle, R.W., 1965. “Geology, Geochemistry, and Origin of the Lead-Zinc-Silver Deposits of the Keno Hill–Galena Hill Area, Yukon Territory”. Bulletin 111, Geological Survey of Canada.

2The base-case AgEq Cut-off grades consider metal prices of $22.50/oz Ag, $1,800/oz Au, $1.00/lb Pb and $1.30/lb Zn, and considers metal recoveries of 95% for Ag, 50% for Au, 94% for Pb and 88% for Zn. AgEq = Ag ppm + (((Au ppm x Au price/gram) + (Pb% x Pb price/t) + (Zn% x Zn price/t))/Ag price/gram) at the above assumed metal prices.

*References to adjoining properties are for illustrative purposes only and are not necessarily indicative of the exploration potential, extent or nature of mineralization or potential future results of the Company’s projects. The Company does not have access to such project or underlying information and has not independently verified any of the scientific, technical or exploration information related to such third-party project.

Resource footnotes

Notes to reported values:

1. The base-case Ag Eq Cut-off grades consider metal prices of $22.50/oz Ag, $1,800/oz Au, $1.00/lb Pb and $1.30/lb Zn, and considers metal recoveries of 95% for Ag, 50% for Au, 94% for Pb and 88% for Zn.

2. Ag Eq = Ag ppm + (((Au ppm x Au price/gram) + (Pb% x Pb price/t) + (Zn% x Zn price/t))/Ag price/gram) at the above assumed metal prices.

Keno Deposit Mineral Resource Estimate Notes:

(1) The effective date of the Keno deposit Mineral Resource Estimate is February 1, 2024.

(2) The Mineral Resource Estimates were estimated by Allan Armitage, Ph.D., P. Geo. of SGS Geological Services and is an independent Qualified Person as defined by NI 43-101.

(3) The classification of the current Mineral Resource Estimate into Inferred mineral resources is consistent with current 2014 CIM Definition Standards - For Mineral Resources and Mineral Reserves.

(4) All figures are rounded to reflect the relative accuracy of the estimate and numbers may not add due to rounding.

(5) The mineral resources are presented undiluted and in situ, constrained by continuous 3D wireframe models, and are considered to have reasonable prospects for eventual economic extraction.

(6) Mineral resources which are not mineral reserves do not have demonstrated economic viability. An Inferred Mineral Resource has a lower level of confidence than that applying to an Indicated Mineral Resource and must not be converted to a Mineral Reserve. It is reasonably expected that most Inferred Mineral Resources could be upgraded to Indicated Mineral Resources with continued exploration.

(7) The Keno mineral resource estimate is based on a validated database which includes data from 293 surface diamond, RC and RAB drill holes totalling 17,654.63 m, and 292 surface and underground channels (Formo) for 450.43 m. The resource database totals 5,429 assay intervals representing 6,734.09 m of data.

(8) The mineral resource estimate is based on 29 three-dimensional (“3D”) resource models for Fox (19), Caribou (4), Formo (4) and Homestake (2), constructed in Leapfrog. Grades for Ag, Au, Pb and Zn were estimated for each mineralization domain using 1.5 metre capped composites assigned to that domain. To generate grade within the blocks, the inverse distance squared (ID2) interpolation method was used for all domains.

(9) Average density values were assigned to each domain based on a database of 54 samples.

(10) Based on their size, shape and orientation, it is envisioned that the Caribou, Fox and Homestake deposits of the Keno project may be mined using open-pit mining methods. Mineral resources are reported at a base case cut-off grade of 50 g/t Ag Eq. The in-pit Mineral Resource grade blocks are quantified above the base case cut-off grade, above the constraining pit shell, below topography and within the constraining mineralized domains (the constraining volumes).

(11) The results from the pit optimization, using the pseudoflow optimization method in Whittle 4.7.4, are used solely for the purpose of testing the “reasonable prospects for economic extraction” by an open pit and do not represent an attempt to estimate mineral reserves. There are no mineral reserves on the Property. The results are used as a guide to assist in the preparation of a Mineral Resource statement and to select an appropriate resource reporting cut-off grade.

(12) It is envisioned that the Formo deposit may be mined using underground mining methods. Mineral resources for Formo are reported at a base case cut-off grade of 150 g/t Ag Eq. The mineral resource grade blocks were quantified above the base case cut-off grade, below surface and within the constraining mineralized wireframes (considered mineable shapes).

(13) Based on the size, shape, general thickness and orientation of the Formo mineralized structures, it is envisioned that the deposits may be mined using a combination of underground mining methods including sub-level stoping (SLS) and/or cut and fill (CAF) mining.

(14) The base-case Ag Eq Cut-off grade considers metal prices of $22.50/oz Ag, $1,800/oz Au, $1.00/lb Pb and $1.30/lb Zn, and considers metal recoveries of 95% for Ag, 50% for Au, 94% for Pb and 88% for Zn.

(15) The pit optimization and base case cut-off grade of 50 g/t Ag Eq considers a mining cost of US$2.20/t mined, and processing, treatment, refining, G&A and transportation cost of USD$25.00/t of mineralized material.

(16) The underground base case cut-off grade of 150 g/t Ag Eq a mining cost of US$65.00/t mined, and processing, treatment, refining, G&A and transportation cost of USD$25.00/t of mineralized material.

(17) The estimate of Mineral Resources may be materially affected by environmental, permitting, legal, title, taxation, socio-political, marketing, or other relevant issues.

The scientific and technical information in this presentation has been reviewed by Scott Petsel, P.Geo., a non-independent qualified person as defined in NI 43-101.