February 17, 2022, Vancouver, B.C., Metallic Minerals (TSX.V: MMG | US OTCQB: MMNGF) ( “Metallic Minerals”, or the “Company”) is pleased to announce drill results from the Central Keno target area, which intercepted high-grade silver mineralization within broad, bulk tonnage intervals akin to those recently discovered at East Keno but previously unknown in this part of Keno Hill. The Caribou target, in particular, is a top priority for resource definition and the Company is currently updating its 3D model based on drilling to date in anticipation of a robust 2022 campaign.

A total of 2,965 meters in 37 reverse circulation (“RC”) holes were completed throughout the Central Keno target areas out of 53 holes in the 6,200 meter (“m”) total 2021 Keno Silver program, along with 20.3 line-kilometers of deep-penetrating IP geophysical surveys. Results from the 26 holes from East and West Keno drilling remain pending.

Central Keno Highlights

- 32 of the 37 Central Keno RC holes intersected intervals of silver mineralization, with two holes lost short of target depth due to challenging ground conditions.

- Multiple high-grade silver intervals were intersected, often within broader, silver-bearing, bulk-tonnage mineralized intervals representing a new target style not previously identified in Central Keno.

- In addition to high-grade, vein-hosted silver typical of the Keno Hill district, significant, stacked regional scale thrust faults and associated high-grade epithermal systems have been identified as an additional host for silver mineralization, providing a major expansion of the district’s overall scale potential.

Caribou Target Highlights

- Drilling at the advanced-stage Caribou target successfully extended high-grade silver mineralization to the north and 400 meters along strike to the south of the previously known extent of the Caribou structure.

- A down-dip intersection, along the northern extent of the Caribou vein, returned some of the highest grades to date and validated the continuity of the high-grade structure at depth, with a 50-meter step out from previously confirmed mineralization.

- Hole KS21-47 intersected 27.4 meters of 146.0 g/t silver equivalent1 (“AgEq”), including a high-grade interval of 3.05 meters (“m”) at 1150.8 g/t AgEq (562.06 g/t Ag, 1.48 g/t Au, 3.0% Pb, 6.96%Zn).

- Hole KS21-55 intersected 19.8 m grading 119.1 g/t AgEq, including a high-grade interval of 1.52 m at 1009.8 g/t AgEq. (147 g/t Ag, 3.24% Au, 0.99% Pb, 10.90% Zn).

- KS21-57 intersected 21.3 m of 147.3 g/t AgEq, including a high-grade interval of 3.05m at 694.9 g/t AgEq (476.35 g/t Ag, 0.40 g/t Au, 4.23% Pb, 0.37% Zn)

- Hole KS21-63 intersected 15.2 m grading 97.2 g/t AgEq, including a high-grade interval of 1.52 m at 627 g/t AgEq (500 g/t Ag, 0.13 g/t Au, 2.35% Pb, 0.45% Zn).

Metallic Minerals Chairman & CEO, Greg Johnson, stated, “We are very encouraged by the results from our work in 2021 which has brought major new insights into the mineralizing controls across the Keno District, particularly at Central and East Keno. Our team has identified significant structural features indicative of regional scale thrust faults that appear to form important permeable zones for hosting high-tenor epithermal-style silver mineralization throughout the central and eastern parts of the Keno District. Work planned for 2022 will follow up on the confluence of these newly identified zones of thrust-associated high-grade epithermal-style silver mineralization with the main phase of Keno-style mineralization and its potential to host high-grade and bulk-tonnage resources.”

“Central Keno continues to show exceptional resource potential through the continued expansion of areas of known high-grade Keno-style silver mineralization, along with this newly recognized epithermal silver mineralization. Drilling in 2021 extended the Caribou target a further 400 meters along strike to the south as well as to the north and down dip, making it, along with the Formo target, a top priority for resource definition of significant scale. Drilling and surface sampling has similarly extended the Homestake target by more than a kilometer along strike, making this historic producer another focus for the 2022 program. Both the advanced-stage, historically productive Caribou and Homestake targets are host to well-defined areas with bonanza grades. Additional results from targets at East and West Keno are anticipated to be reported in the coming weeks, preceded by key updates with respect to our La Plata project in Colorado.“

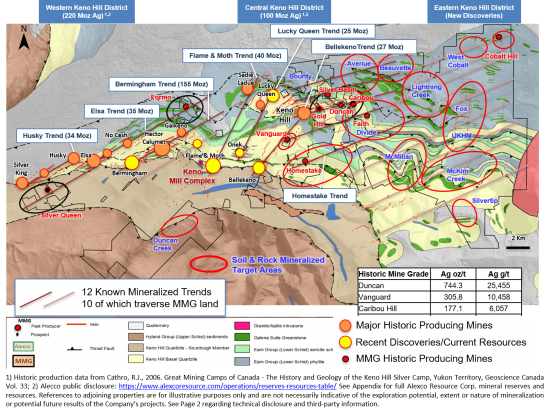

Figure 1 – Keno Silver District Geology and Deposits

Central Keno Hill Silver District

The central part of the Keno Hill Silver District is host to over 100 million ounces of past production and current Indicated resources in shallow deposits that to date have not previously seen systematic exploration to depth or along strike. Central Keno was one of the original discovery areas in the region and hosted the historic producing Keno Hill mine, along with 8 other high-grade deposits including those on Metallic Minerals land holdings. Metallic Minerals’ work to date in this area shows the presence of a major structural corridor that is comparable in surface expression and structural setting to the +150 million-ounce Bermingham-Calumet system in the more extensively explored western part of the district.

Caribou Target Area

The Caribou target in the central part of the district is one of the most advanced individual targets at the Keno Silver Project. The Caribou deposit historically produced very high-grade material grading more than 1,000 g/t silver from near surface and is interpreted to be a significant connecting structure between the main shear structures in the Keno Summit structural corridor. The Caribou deposit spatially occurs within a high-level silver-in-soil anomaly of over 10 g/t AgEq that extends over 2.5 km long by 1.5 km in width and that remains open to expansion.

As part of the exploration program in 2021, Metallic Minerals completed the first-ever application of deep-sensing IP geophysics on the Keno Silver project using Simcoe Geoscience’s Alpha IPTM system. Two deep-looking IP lines were completed across the Central Keno area, which identified significant conductive features that spatially correspond with the newly mapped regional scale thrust fault structures and associated epithermal style silver mineralization. This IP survey in combination with the drilling and detailed mapping has allowed the Metallic Minerals technical team to identify major conductive features that are spatially associated with kilometer-scale soil and magnetic anomalies and significant silver mineralization. This combination of utilizing drilling, geophysics and soil sampling is a highly effective tool set for targeting mineralization across the Keno Hill silver district.

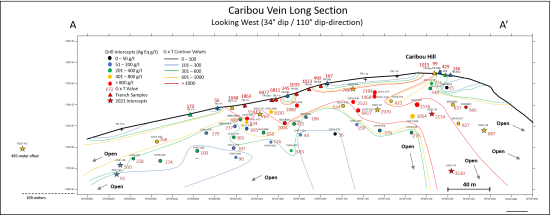

Figure 2 – Caribou Vein Long Section

Drilling in 2021 returned significant step out extensions of mineralization from the main Caribou deposit to the north, south and down dip. Eight of these holes intersected continuous mineralized zones from 15 to 64 m width including a 400-meter step out that encountered 15.2 m grading 97.2 g/t AgEq with 1.5 m grading 628 g/t AgEq (500 g/t Ag, 0.13 g/t Au, 2.35% Pb, 0.45% Zn). This zone appears to be spatially associated with the location of one of the newly mapped regional thrust faults that can host high-grade epithermal silver mineralization. The high-level silver-in-soil anomaly continues for another 1.5 km to the south along strike from this southernmost drill hole at Caribou.

In addition, holes KS21-46 and -47 tested extension of the Caribou deposit to the north and downdip. These holes both confirmed the continuation of strong silver tenor both on strike to the north and at depth with KS21-47 returning one of the highest-grade down dip holes drilled to date intersecting 1597 g/t AgEq over 1.5 meters within a mineralized zone of 27.4 m width grading 146 g/t AgEq.

Table 1- Highlight 2021 Drill Results from the Caribou Target

| Hole | From (m) | To (m) | Width (m) | AgEq (g/t) | Ag (g/t) | Au (g/t) | Pb (%) | Zn (%) |

|---|---|---|---|---|---|---|---|---|

| KS21-46 | 42.67 | 44.2 | 1.53 | 71.6 | 1.5 | 0.73 | 0.01 | 0.00 |

| 79.25 | 94.49 | 15.24 | 81.9 | 18.7 | 0.04 | 0.17 | 1.11 | |

| incl | 79.25 | 88.39 | 9.14 | 85.6 | 24.0 | 0.03 | 0.23 | 1.05 |

| incl | 80.77 | 82.3 | 1.53 | 448.7 | 125.0 | 0.13 | 1.29 | 5.51 |

| incl | 92.96 | 94.49 | 1.53 | 260.4 | 31.0 | 0.20 | 0.22 | 4.29 |

| KS21-47 | 92.96 | 120.4 | 27.44 | 146.0 | 70.6 | 0.18 | 0.40 | 0.88 |

| incl | 109.73 | 112.78 | 3.05 | 1150.8 | 562.1 | 1.48 | 3.00 | 6.96 |

| incl | 109.73 | 111.25 | 1.52 | 1597.1 | 850.0 | 1.05 | 2.57 | 11.46 |

| KS21-52 | 0 | 62.48 | 62.48 | 35.3 | 21.9 | 0.01 | 0.23 | 0.07 |

| incl | 1.52 | 25.91 | 24.39 | 79.7 | 51.9 | 0.02 | 0.55 | 0.09 |

| incl | 7.62 | 12.19 | 4.57 | 297.0 | 191.3 | 0.09 | 2.16 | 0.26 |

| incl | 9.14 | 10.67 | 1.53 | 500.6 | 340.0 | 0.22 | 2.94 | 0.49 |

| KS21-54 | 16.76 | 42.67 | 25.91 | 53.4 | 35.2 | 0.01 | 0.30 | 0.11 |

| incl | 21.34 | 36.58 | 15.24 | 83.8 | 57.4 | 0.01 | 0.50 | 0.12 |

| incl | 22.86 | 24.38 | 1.52 | 517.0 | 387.0 | 0.07 | 2.74 | 0.30 |

| KS21-55 | 44.2 | 76.2 | 32 | 75.6 | 14.8 | 0.19 | 0.09 | 0.82 |

| incl | 44.2 | 64.01 | 19.81 | 119.1 | 22.7 | 0.30 | 0.15 | 1.30 |

| incl | 50.29 | 60.96 | 10.67 | 210.8 | 37.1 | 0.55 | 0.26 | 2.34 |

| incl | 50.29 | 54.86 | 4.57 | 467.2 | 75.8 | 1.29 | 0.58 | 5.21 |

| incl | 51.82 | 53.34 | 1.52 | 1009.8 | 147.0 | 3.24 | 0.99 | 10.90 |

| KS21-57 | 33.53 | 54.86 | 21.33 | 147.3 | 100.4 | 0.07 | 0.93 | 0.09 |

| incl | 33.53 | 42.67 | 9.14 | 332.4 | 227.7 | 0.16 | 2.15 | 0.15 |

| incl | 35.05 | 41.15 | 6.1 | 486.9 | 335.2 | 0.23 | 3.12 | 0.20 |

| incl | 35.05 | 38.1 | 3.05 | 694. 9 | 476.4 | 0.40 | 4.23 | 0.37 |

| KS21-61 | 33.53 | 77.72 | 44.19 | 24.9 | 11.0 | 0.01 | 0.04 | 0.23 |

| incl | 50.29 | 59.44 | 9.15 | 102.6 | 47.7 | 0.05 | 0.16 | 0.92 |

| incl | 51.82 | 53.34 | 1.52 | 337.1 | 170.0 | 0.21 | 0.30 | 2.83 |

| KS21-63 | 30.48 | 45.72 | 15.24 | 97.2 | 75.2 | 0.02 | 0.40 | 0.08 |

| incl | 30.48 | 38.1 | 7.62 | 160.1 | 125.2 | 0.03 | 0.65 | 0.12 |

| incl | 33.53 | 35.05 | 1.52 | 627.8 | 500.0 | 0.13 | 2.35 | 0.45 |

1Silver equivalent (Ag Eq) values assume Ag $19/oz, Pb $1.05/lb, Zn $1.30/lb, Au $1,800/oz and 100% metallurgical recovery. Sample intervals are based on measured drill intercept lengths.

Exploration to date has hit more than 70 mineralized intersections on the Caribou system over a strike distance of 700 m and down to 100 m depth. The Caribou deposit remains open to expansion to the south, north and down dip making it a top priority for resource focused drilling efforts in 2022. The highlighted results in Table 1 above build upon prior diamond drilling on the Caribou target by Metallic Minerals, results of which can be found here.

Metallic will look to follow up the 2021 success with diamond drilling in 2022 with intent to establish an initial resource at Caribou. Additional diamond drilling will be planned to test the newly extended southern strike and provide context for its association with the thrust structure. Importantly, 2021 drilling encountered ultra-high-grade, Keno-style vein intersects within much broader, bulk tonnage intervals similar to those discovered previously at East Keno in 2020.

Homestake

The historically productive Homestake target is located south of the Keno Summit target area along a parallel structural corridor. The style of the Homestake structure is comparable to those seen at the Keno Summit and in the more developed Western Keno areas. Homestake is comprised of two parallel vein structures within a broad structural corridor over 200 meters wide that has a demonstrated strike length of over 1 km in the host Keno Hill quartzite. Homestake #1 vein shows classic Keno-style, high-grade silver-lead-zinc mineralization, while the #2 vein can also show high gold grades with silver, which is characteristic of some structures in the larger deposits within the Keno Hill Silver District. The highest grades to date include assays of 4,027 g/t silver from drilling and 4,717 g/t silver from trenching on the Homestake #1 vein, and 22.1 g/t gold with 332 g/t silver from trenching on the Homestake #2 vein Prior drill results from Homestake can be found here.

To date there are 21 drilled vein intersections grading more than 600 g/t silver equivalent on the Homestake structures, including five that exceed 10 g/t gold on the Homestake #2 structure. Work in 2021 at Homestake focused on wide-spaced reconnaissance drilling along the main trends as well as extension of the open-ended soil anomalies. The soil sampling work expanded the high-level silver-in-soil anomaly associated with the Homestake mineralized system to 3 km in length by 1.5 km in width with the anomalies still open to further expansion. Intersections of anomalous silver over significant widths indicate a strike length of 1.5 km for the Homestake system. The next phase of systematic testing of these structures will be designed to delineate areas of the high-grade and bulk-tonnage toward development of an initial resource at Homestake.

About the Keno Silver Project

Exploration by Metallic Minerals at the Keno Silver project continues to systematically build on the Company’s 3D geologic database covering the east, central and western portions of the prolific Keno Hill silver district. The project includes eight high-grade, shallow past-producing mines that have yet to be subjected to modern exploration due to previously unconsolidated land ownership. Along the known, historically productive trends in the central and western parts of the district, the Company has advanced three targets towards an initial resource estimate along with identifying 12 priority multi-kilometer-scale early-stage targets in the under-explored eastern and southern parts of the district where initial drilling has returned significant high-grade Keno-style mineralization as well as bulk-tonnage style silver mineralization.

About Metallic Minerals

Metallic Minerals Corp. is a growth-stage exploration company, focused on high-grade silver and gold projects in underexplored, brownfields mining districts of North America. Our objective is to create shareholder value through a systematic, entrepreneurial approach to exploration in the Keno Hill silver district, La Plata silver-gold-copper district, and Klondike gold district through new discoveries and advancing resources to development. Metallic Minerals has consolidated the second-largest land position in the historic Keno Hill silver district of Canada's Yukon Territory, directly adjacent to Alexco Resource Corp ’s operations, with nearly 300 million ounces of high-grade silver in past production and current M&I resources. In addition, exploration at the recently acquired La Plata silver-gold-copper project in southwestern Colorado is targeting a silver and gold-enriched copper porphyry and adjacent high-grade silver and gold epithermal systems. The Company also continues to add new production royalty leases on its holdings in the Klondike gold district in the Yukon. All three districts have seen significant mineral production and have existing infrastructure, including power and road access. Metallic Minerals is led by a team with a track record of discovery and exploration success on several major precious and base metal deposits, as well as having large-scale development, permitting and project financing expertise.

About the Metallic Group of Companies

The Metallic Group is a collaboration of leading precious and base metals exploration companies, with a portfolio of large, brownfields assets in established mining districts adjacent to some of the industry’s highest-grade producers of silver and gold, platinum and palladium, and copper. Member companies include Metallic Minerals in the Yukon’s high-grade Keno Hill silver district and La Plata silver-gold-copper district of Colorado, Group Ten Metals in the Stillwater PGM-nickel-copper district of Montana, and Granite Creek Copper in the Yukon’s Minto copper district. The founders and team members of the Metallic Group include highly successful explorationists formerly with some of the industry’s leading explorer/developers and major producers. With this expertise, the companies are undertaking a systematic approach to exploration using new models and technologies to facilitate discoveries in these proven, but under-explored, mining districts. The Metallic Group is headquartered in Vancouver, BC, Canada, and its member companies are listed on the Toronto Venture, US OTC, and Frankfurt stock exchanges.

FOR FURTHER INFORMATION, PLEASE CONTACT:

Website: mmgsilver.com Phone: 604-629-7800

Email: cackerman@mmgsilver.com Toll Free: 1-888-570-4420

Qualified Person

The disclosure in this news release of scientific and technical information regarding exploration projects on Metallic Minerals’ mineral properties has been reviewed and approved by Scott Petsel, P.Geo., Vice President, Exploration, who is Qualified Person as defined by National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”).

Quality Assurance / Quality Control

All samples were assayed by 36 Element Aqua Regia Digestion ICP-MS methods at Bureau Veritas labs in Vancouver. with sample preparation in Whitehorse, Yukon and geochemical analysis in Vancouver, British Columbia. Samples with over limit silver and gold were re-analyzed using a 30-gram fire assay fusion with a gravimetric finish. Over-limit lead and zinc samples were analyzed by multi-acid digestion and atomic absorption spectrometry. All results have passed the QAQC screening by the lab and the company utilized a quality control and quality assurance protocol for the project, including blank, duplicate, and standard reference samples.

Forward-Looking Statements

Forward Looking Statements: This news release includes certain statements that may be deemed "forward-looking statements". All statements in this release, other than statements of historical facts including, without limitation, statements regarding potential mineralization, historic production, estimation of mineral resources, the realization of mineral resource estimates, interpretation of prior exploration and potential exploration results, the timing and success of exploration activities generally, the timing and results of future resource estimates, permitting time lines, metal prices and currency exchange rates, availability of capital, government regulation of exploration operations, environmental risks, reclamation, title, and future plans and objectives of the company are forward-looking statements that involve various risks and uncertainties. Although Metallic Minerals believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results or developments may differ materially from those in the forward-looking statements. Forward-looking statements are based on a number of material factors and assumptions. Factors that could cause actual results to differ materially from those in forward-looking statements include failure to obtain necessary approvals, unsuccessful exploration results, changes in project parameters as plans continue to be refined, results of future resource estimates, future metal prices, availability of capital and financing on acceptable terms, general economic, market or business conditions, risks associated with regulatory changes, defects in title, availability of personnel, materials and equipment on a timely basis, accidents or equipment breakdowns, uninsured risks, delays in receiving government approvals, unanticipated environmental impacts on operations and costs to remedy same, and other exploration or other risks detailed herein and from time to time in the filings made by the companies with securities regulators. Readers are cautioned that mineral resources that are not mineral reserves do not have demonstrated economic viability. Mineral exploration and development of mines is an inherently risky business. Accordingly, the actual events may differ materially from those projected in the forward-looking statements. For more information on Metallic Minerals and the risks and challenges of their businesses, investors should review their annual filings that are available at www.sedar.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.